I take the view that planning the future is very hard and you will never have all the information you need for obvious reasons. So when it comes to the government trying to shape development, it makes a lot of sense to allow people do stuff and learn what works with a view to supporting those things.

This applies to agriculture as well. This is the part of the economy that seems to generate the most noise these days. Whether that noise translates to real action is anybody’s guess. But there are things going on that give hints as to what Nigeria can do to help them along.

The Central Bank of Nigeria recently released some data on utilisation of itsAgricultural Credit Guarantee Scheme Fund. There’s a way to read the data that allows us to tell a story about what is happening with agriculture in Nigeria. It is not all of the story of course but it’s better to tell one based on data as opposed to the usual hot air of ‘Nigeria is spending $billions importing xxx when it can be produced at home’.

The gist of the fund is that it allows banks lend to agriculture with the CBN providing some guarantees to the loans if they go bad. This allows banks lend at a much lower interest rate (8%) than they normally would. Lending to agriculture in a country like Nigeria is very risky — you lend a farmer money to plant tomatoes and then tuta absoluta wrecks the whole crop meaning he can’t repay you as he can’t turn himself to money.

So how has this scheme been doing lately? Let’s see

Demand for Loans

The data is grouped by states so this allows us see where people are taking up the loans the most. In a country like Nigeria, it’s not easy to demand for loans —that is, a lot of people cannot meet the requirements to take a loan even if the bank wants to lend to them. They have nothing to pledge as collateral or even any way for the bank to identify them. So if a lot of farmers are demanding loans in a state, it is safe to conclude that that state is doing something right.

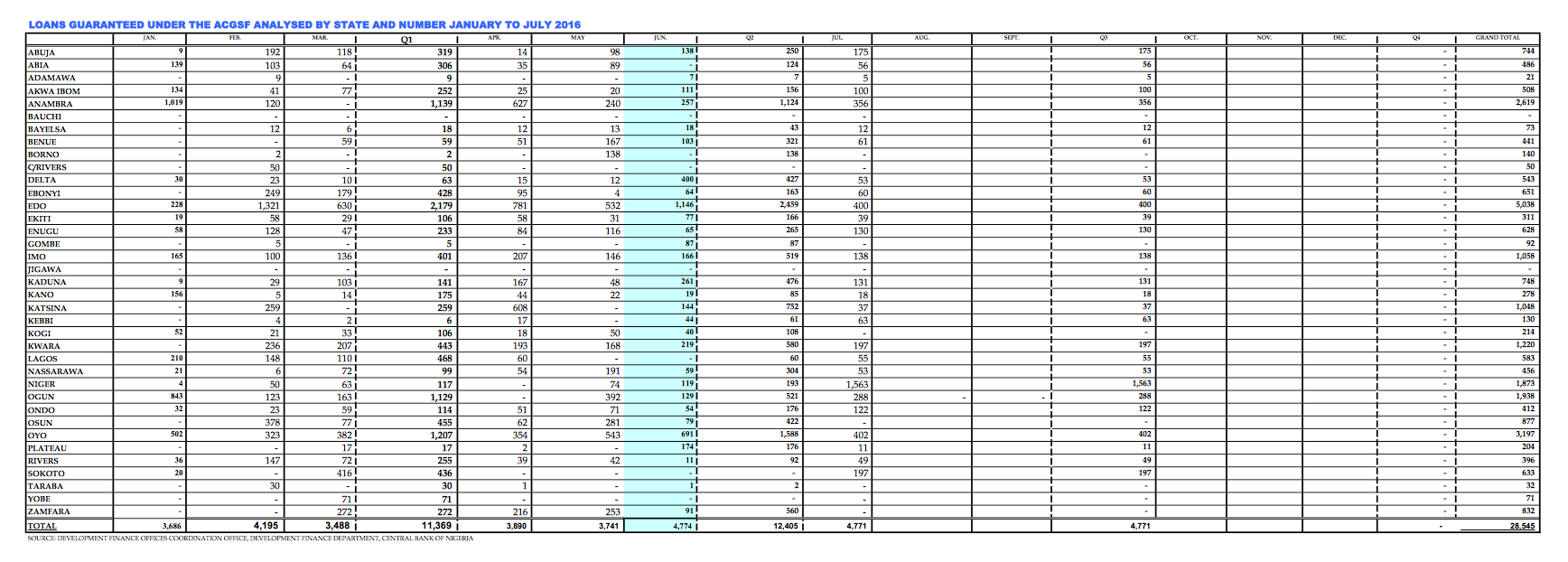

Sorry if it hurts your eyes — but this is how CBN presented the data in their report. We can see clear differences across the states. Anambra, Edo, Imo, Katsina, Kwara, Niger, Ogun and Oyo are the standout performers — 63% of all the loans under the scheme from January to July this year went to those 8 states (22% of the states in Nigeria). Edo, in particular, is blowing everyone else out of the water.

Let’s illustrate this with a point about Adamawa. Only 21 farmers got loans under the scheme in 7 months. Why? Here’s a clue from a few days ago in the papers:

Adamawa State Governor, Jibrillah Bindo, has expressed concern over the Central Bank of Nigeria’s rejection of about 100,000 farmers’ participation in the “Anchor Borrowers Programme’’ due to hitches in their registration.

Bindo said this in Yola, the state capital, on Thursday during the presentation of fertilisers and herbicides to registered beneficiaries to kick off the scheme.

Bindo said, “I am worried and disturbed that about 100,000 farmers captured in the national anchor borrowers initiative in the state were rejected by the CBN due to lack of Bank Verification Number.

This is a different scheme but you can see it’s a related problem. Farmers are farmers. Most of them are likely illiterates. For them to meet the requirements of getting these loans, they will need support to getting their documents, filling the forms etc. Did nobody in the Adamawa government check to see that the farmers applications were in order before wasting their time and sending it to CBN? Having so many farmers rejected for lack of BVN seems like a schoolboy error.

These 8 states — Edo, Anambra and Oyo in particular — are definitely doing something right to make it easier for farmers to access these loans. Having proper land documents is one of the requirements for the loans so maybe these states make accessing land easier? Nigerians are also generally (over)optimistic but I imagine you will only take a loan if you are confident it is worth the trouble.

It is one of the happy incidents of the federal system that a single courageous state may, if its citizens choose, serve as a laboratory; and try novel social and economic experiments without risk to the rest of the country

The above quote from Justice Brandeis says that a state like Adamawa should reach out to Edo and find out how it’s managing to get so many of its farmers loans.

Loan Sizes

This is not much different from the demand for loans above but the differences nonetheless tell us something.

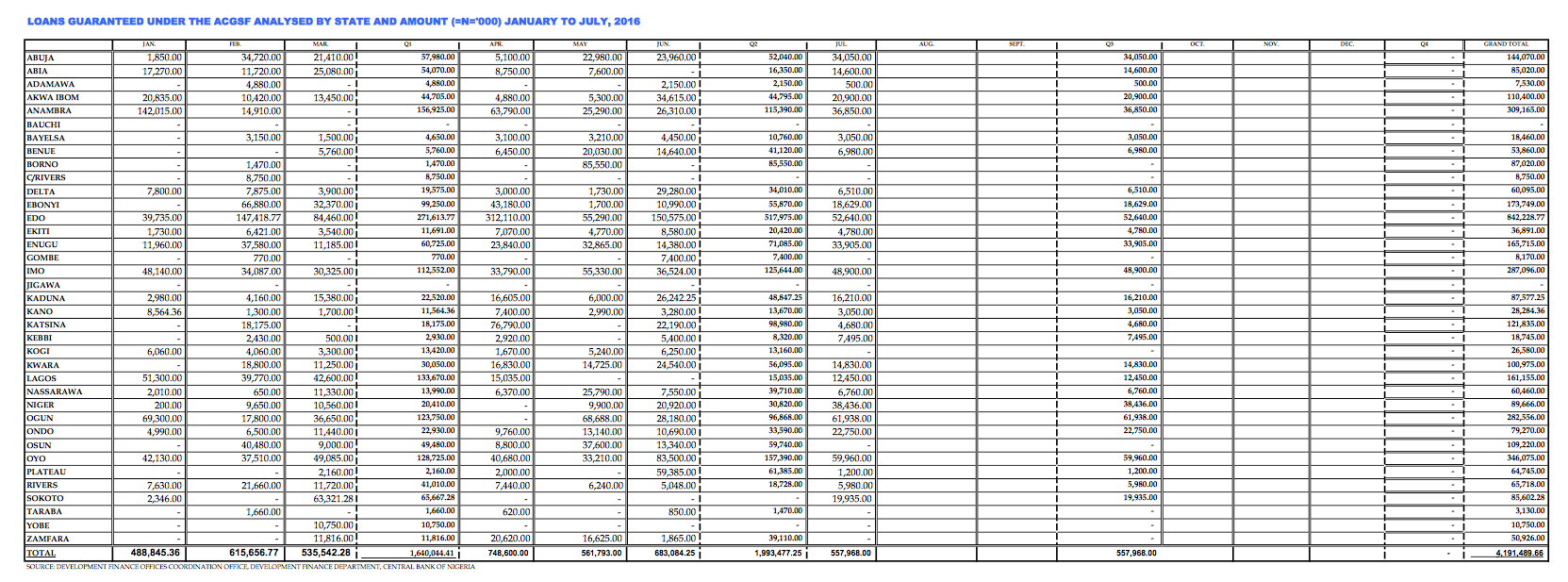

From January to July this year, a total of N4.2bn has been lent to over 28,000 farmers. Edo’s 5,000+ farmers got N842m in loans. No surprises there. But look at Imo —just over 1,000 farmers got N287m while Ogun with almost 2,000 farmers got N282m. That is, each Imo farmer is got something like N287,000 while each Ogun farmer got N148,000.

Why might this be the case? Perhaps Imo farmers plant more high-value crops or animals? Either way, we can tell a story that Imo farmers are more confident than Ogun farmers based on what the data is telling us.

But there’s more

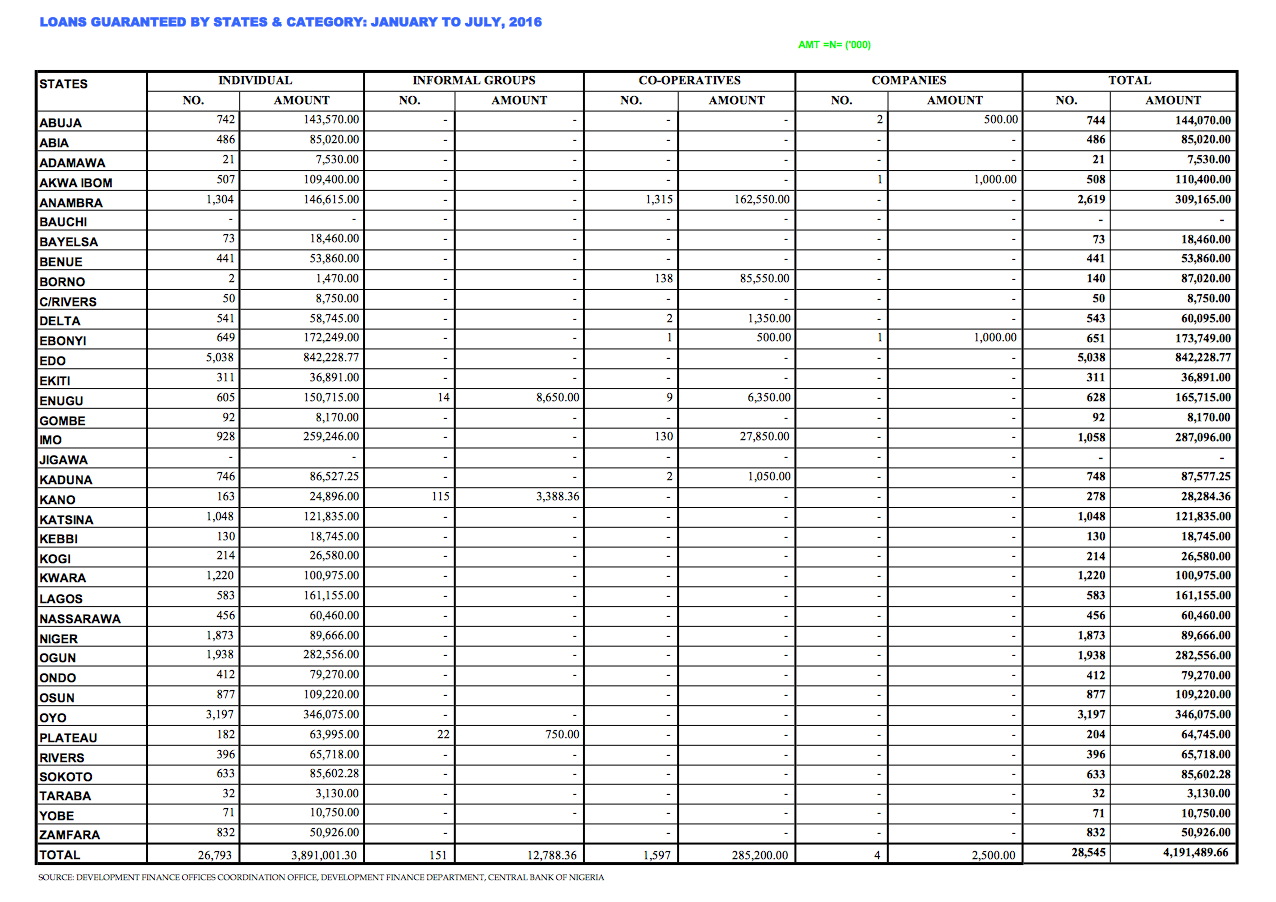

Based on this, it looks like it’s a good idea for farmers to come together as co-operatives. Certainly, it gives banks greater confidence in lending to them as the risk is spread wider — they are unlikely to all go bankrupt at the same time. It definitely works for Anambra as half of the loans there went to co-ops while Imo farmers did well under the arrangement too.

Borno is perhaps a better example of how useful co-ops can be. Only 2 farmers managed to go loans individually in the 7 month period. In a state devastated by Boko Haram, it makes sense for farmers to team up to make a livelihood. If this is an outcome of an existing state policy, then well done to them. They need to do more to get farmers teaming up as co-ops.

This rule doesn’t hold for Edo though. Maybe we will find out why shortly.

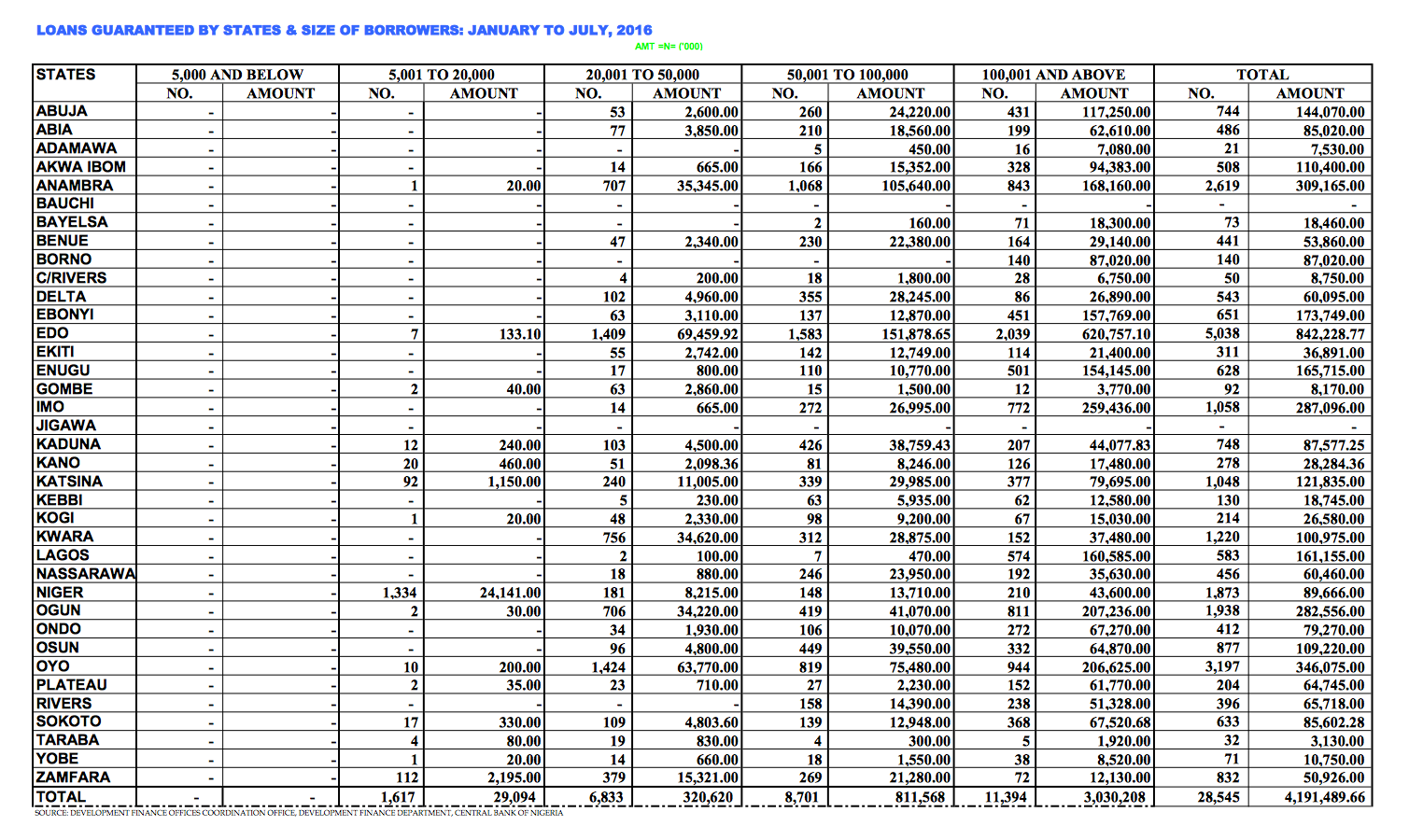

Here we can see why Niger with 1,873 farmers only accessed N90m in loans while Imo with 1,058 farmers got N287m —most of the Imo farmers’ loans are for N100,000 and above while the Niger loans are between N5,000 and N20,000. Where the Niger farmers stop is where the Anambra farmers start in loan sizes —loans in Anambra are mostly N50,000 and above. I don’t know what a farmer can do with a N5,000 loan beyond subsistence farming but it is what it is. Niger state needs to help its farmers scale up so they can grow.

But What Are They Farming?

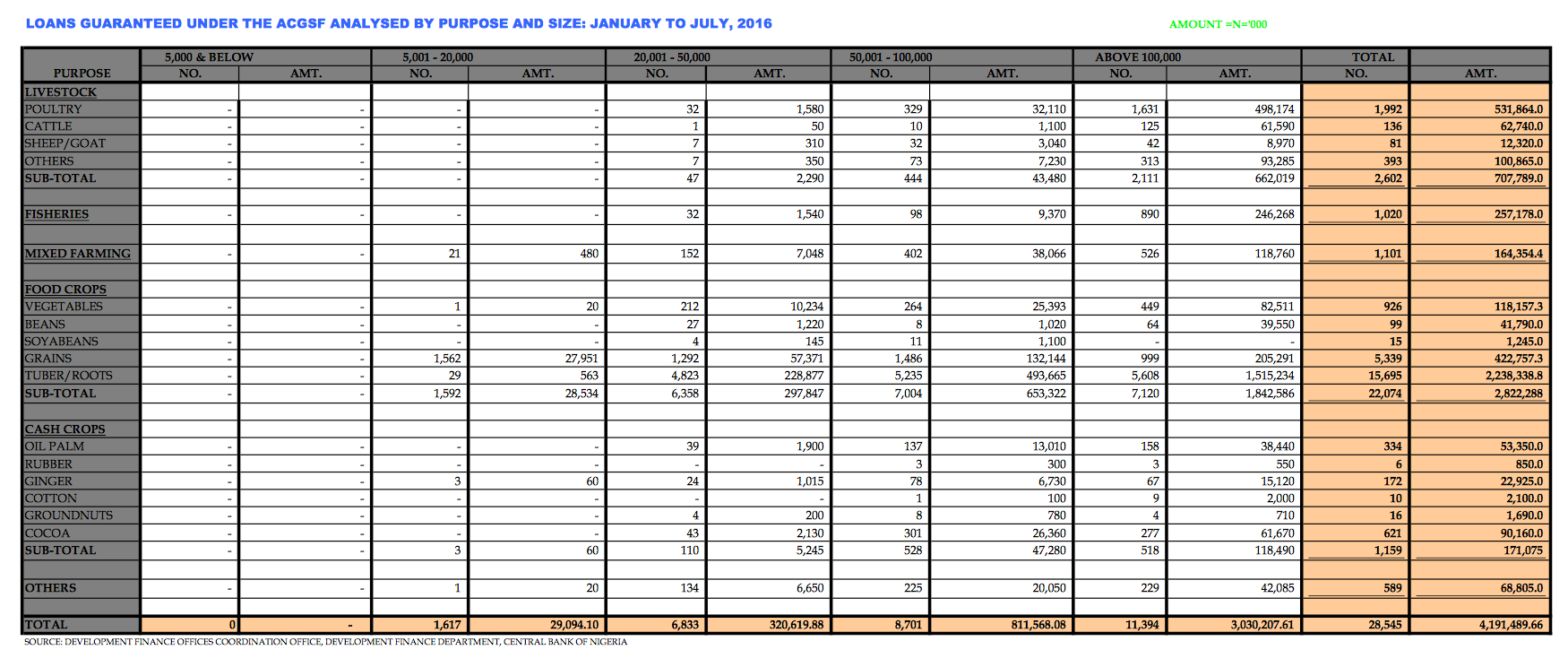

The next question is obviously what the farmers are using the loans for. The CBN data on this is good but unfortunately, it doesn’t break it down by state to allow us drill down to what exactly is going on where.

Nigeria is a crop country judging by this data. Specifically, tubers and roots is where the money is going. So yams, potatoes, cassava and the likes. This is not a surprise as Nigeria is by far the world’s largest yam producer (just that you people are also the world’s largest consumers of yams so you have to import sometimes to meet demand). More than half of the loans go to farm this stuff. Not just that, the bulk of the loans to people farming tubers and roots were for N100,000 and above.

One way we can interpret this is that tubers and roots are the safest things to grow in Nigeria today in terms of planting, getting them to the market and meeting a ready demand for them. The banks seem to agree as this is where they are pouring the loans. Out of 28,545 farmers who got loans, 22,074 were tuber and root farmers! 77% of all loans. Perhaps this also busts some myths in Nigeria about where yam is farmed. Ask any Nigerian and they will probably say yams are from Niger and Benue. But go back to the data above and Benue hardly figures in any serious way and Niger does puny stuff. Perhaps the yams are actually from Edo and Oyo?

One of the ways hunger was defeated across Asia was that they focused strictly on 2 crops — rice and wheat. Labour, capital and technology were poured into those 2 crops and they got so good at it. Prices then came down and down and everyone could eat rice and wheat. The rest was then a matter of getting what else to eat with it. This is one of the reasons why Nigeria will continue to import rice from Thailand until we can match the focus and investment of the Asians in that crop. But do we really need to?

Nigeria can focus on what it is already good at and pour investments and resources in it until it gets so good at it that no one else can match her. Yams already are a good foundation to build on. By focusing resources along the value chain, Nigeria can grow yams so cheaply and even come up with various ways to turn it into flour that can be exported for forex. Whatever you’re good at, get excellent at it and ship it out to the world. It’s an advantage. China produces a lot of stuff but it also imports corn, soybean, palm oil, sugar, cotton etc. By the data, we can also get better at poultry and export chicken. You need to have light for that one sha.

Finally, look at some of the agricultural products that government ministers like to make noise about. Nigeria must produce cotton to revive the textile industry’s great glory! Only 10 farmers took a total of N2.1m in loans for it. We need to go back to groundnut pyramids like the glory days! 16 farmers took N1.7m in loans to plant groundnuts. It’s time to move on, please. Nigeria loses ten thousand billions of dollars every 5 minutes importing fish when we can produce it at home. This must stop! Only 6% of loans went to fishing.

The data is different from the reality almost every time.

Battle of the Sexes

No need to waste time on this one. Most people intuitively know the answer to the question of who is more credit worthy between men and women.

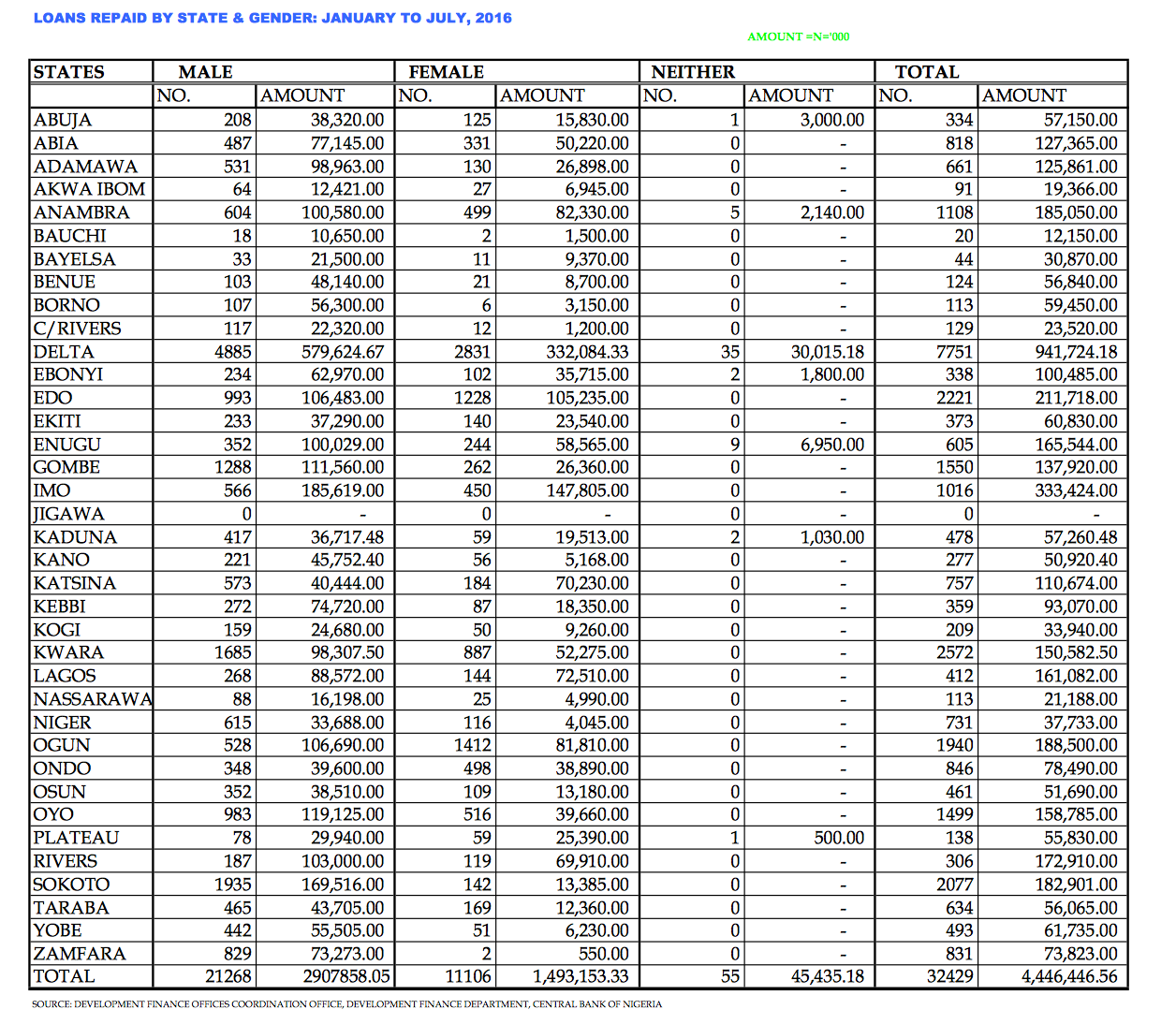

First, let’s see the breakdown of loans between men and women for the period

Women got 37% of all the loans given out. I wonder about the 420 people who are classed as neither male or female. Is Denrele now into farming? (sorry, I apologise). Sadly, women seem to be getting smaller loans as their loans are only 32% of the actual loan sizes. Look at Edo as an example — more women got loans than men (51% to 49%) but they only got 40% of the actual loans. Perhaps this is a function of what women choose to farm but given that loans are heavily skewed towards tubers and roots, it is hard to see this as the case. Not good enough.

Even where more women than men got loans like in Kwara (64% to 36%), they still got a smaller share of the total amount loaned to the state (55% to 45%). It’s hard to see women punching at their weight anywhere in the data talk less of above their weight.

Why is this important? Have a look below

Now we see the total amounts repaid during the year. That is, loans that had been given out in prior periods. Let’s test Edo. 55% of the people who repaid loans were women. If we assume the distribution was the same as when the loans were given out (51%), now women are punching above their weight.

Overall, 34% of the farmers who repaid loans were women and they also repaid 34% of the total amount repaid. You might say this is fair but remember that women were 37% of the borrowers, they got 32% of the total loans. It’s not a bad idea to lend more to women or even just lend the same amount we lend to men — they seem more credit-worthy. This chimes with what I’ve heard from bankers and what Governor Amosun of Ogun state said on TV recently. No preferential treatment is needed. Just equal treatment will do.

1978 to Date

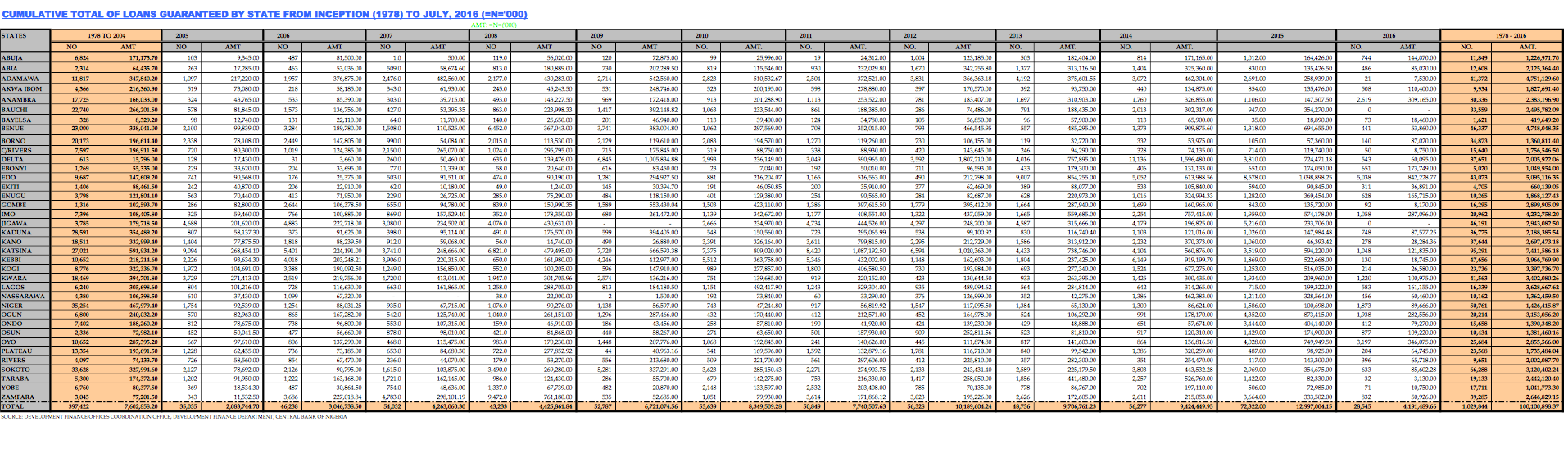

Finally, the ACGSF started in the year I was born (you’ve all been asking for my age and I have now told you) and CBN claims to have the data from then till now. You will need to squint to see it

In 38 years, Nigeria has lent roughly N100bn to just over 1 million farmers under this scheme. Compare that amount to what can be stolen on any quiet weekend in Nigeria. Is it really a surprise that the country is struggling to feed itself? Or that farming is stressful and hardly attracts anyone? Or that much of Nigerian agriculture remains at subsistence level?

This is not all of the story of course — more is lent to agriculture through various other schemes. But still, if you are putting an average of just N3bn (cigarette money for an upcoming looter in Nigeria) per year into agriculture, should you really be surprised when you have to import fish?

To the extent that we can rely on this data, what government officials make noise about is completely different from the reality on the ground. This is where we ought to start telling ourselves the truth. It is not by making noise up and down and declaring war on imported food. If you can’t feed yourself, you should be thankful that the Thai government was pouring $15bn a yearinto rice until recently to make it cheap for people like you.

There’s a lot of potential in agriculture for Nigeria. Not just to feed and employ people or to save forex, but to help people develop skills that can then be transferred elsewhere as the economy develops and becomes more complex.

But first, let the noise stop and let’s have a clear-headed approach to dealing with the problems.

_________________

Op–ed pieces and contributions are the opinions of the writers only and do not represent the opinions of Y!/YNaija

This op-ed was first published here

Leave a reply