Written by Fawehinmi Feyi

Nigeria’s GDP figures were released yesterday. For people who like to watch horror movies, the numbers were like a dream come true. There was blood everywhere.

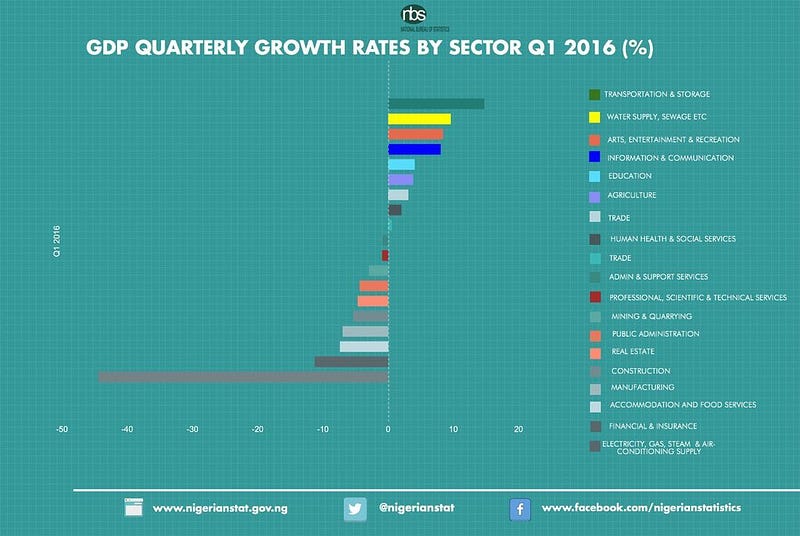

The infographic below gives a breakdown by sector

You can see that those moving backward are stronger than those moving forward. The overall effect is that the Nigerian economy shrank, compared to a year ago.

Some parts of the economy like entertainment and recreation (smh) are growing. Other parts like manufacturing and construction are shrinking. You might wonder why this means the whole economy is shrinking if the story is mixed. The answer is that different parts of the economy carry different weights. Take Transportation & Storage — the sector grew by 30.2% compared to a year ago. This is a good thing. Alas, that whole sector is just 1% of the economy. So even if it grows really well as it is doing, it cannot rescue the whole economy on its own.

But consider manufacturing. This sector has 13 categories ranging from oil and gas to cement to plastic and rubber to motor vehicles. It’s a fairly big part of the economy and makes up 10% of GDP. In the first quarter of 2016, this sector shrank by 3% compared to a year ago. If 1% of your body grows by 30% and 10% of your body shrinks by 3%, you will not notice much of a difference if you stand on a scale.

And that is what happened to Nigeria in Q1 of 2016. By the time you take into account all the sectors that managed to grow in the quarter and weigh them against the sectors that shrank, the total effect is that the shrinkers won the tug of war. Overall, the economy shrank by 0.36% in the quarter.

Heckuva Job

In 1782, a young lawyer named John Sinclair was worried about Britain losing ground in the war with America. He wrote to Adam Smith expressing his fear that, given the way the war was going, Britain was surely going to be ruined. Adam Smith replied thus

Be assured, my young friend, that there is a great deal of ruin in a nation

Smith’s point was that it takes a lot of hard work to completely ruin a nation. Hard work in this case meaning, bad policy after bad policy, mistake after mistake, stupidity after stupidity and nonsense after nonsense. You need all of these things to happen consistently, sans interregnum, for a nation to be ruined.

Nigeria is a poor country. There is so much that still needs to be done to improve the place. There are still low hanging fruits everywhere that can be plucked just by improving things slightly. There are tens of millions of poor people across the country that even N1,000 will make a difference to. There are places that can be economically transformed simply by fixing a road. Just boosting agriculture with better seeds will do wonders for the country.

What all of this means is that even if you shut down the Nigerian government and close Abuja, the economy should still grow. It’s not the same in advanced economies where all the low-hanging fruit have been plucked. A developing country should grow almost automatically. The difference that can be made in terms of policy is how quick that growth should be. So Cote d’Ivoire might grow faster than Kenya because the government there has better policies, but both of them will continue to grow.

Bearing all of this in mind, what the Buhari government has managed to achieve with this negative growth is quite something. It has pursued policies which have shrunk the economy. Nothing shows this more than in manufacturing. Since last year, the government has pursued policies that it says were meant to favour manufacturing and other ‘essential’ services. This is the reason for the N199 to $1 rate — to help manufacturers and those importing ‘raw materials’ get cheaper dollars and prevent inflation and other bad things from happening. Things that do not fit with this vision have been banned from getting forex at official rates while those who want to import ‘glamorous dresses’ can go and jump in the nearest river.

And yet look at what has happened to manufacturing. It is shrinking. After a year of directing subsidised forex to manufacturing, it is now 3% smaller than it was a year ago. Even worse, compared to Q4 2015, it has shrunk by 12%. It is declining and declining fast. How about the golden child of Nigerian manufacturing — Alhaji Putin and his Dangote Cement?

Cement GDP at -4.35% in q1 2016 from 21.3% and 23.2% in q4 and q1 2015 respectively

— Dr Yemi Kale (@sgyemikale) May 20, 2016

That’s right — that one too is shrinking. As I have been saying, if you monitor the forex reports in the newspapers every week (when they bother to publish the full details), you will see that Alhaji has been getting roughly $15m per week at the subsidised rate of N199. Yet this cement sector is one of the ones now pulling down the Nigerian economy. One cynical person even said this might explain why Alhaji ‘offered’ to build a road using cement. If he can’t sell the overpriced stuff to Nigerians, there is always the government — a reliable maga — to sell it to.

There is a great deal of ruin in a nation. But it takes hard work and deliberate effort to come up with a policy that drags the whole economy down. Heckuva job, as the Americans say.

Monetary Policy Hurdles

We have now seen the result of the government’s stated policy and it is exactly as any reasonable person expected. None of this is a surprise. No doubt about it, there are many many things currently wrong with the Nigerian economy, but the job of any government should be to first, do no harm. The effect of what the Buhari government has been doing in the past year is to choke the economy. Yes, people have complained about ‘jobless growth’ in the past but here you have something even worse — negative growth.

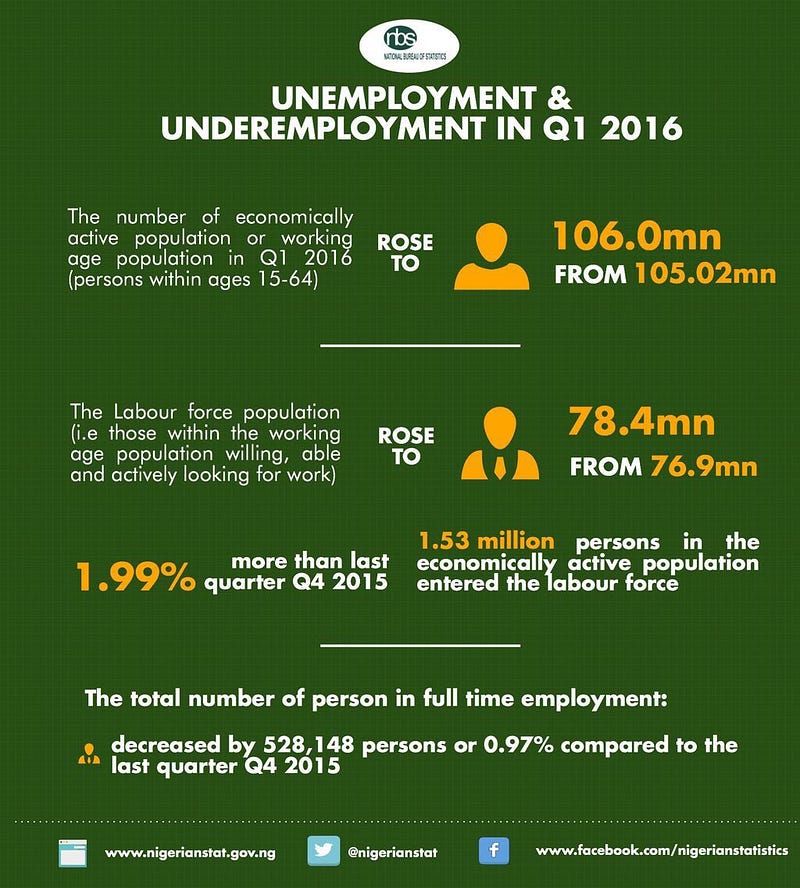

The above is what negative growth looks like. More than half a million people lost their jobs in Q1 2016. The result of all the sex Nigerians have been having over the years also continues to manifest itself — another 1.5 million Nigerians entered the labour force i.e reached the age where they are now eligible for work.

A common narrative is that Buhari is intransigent and stubborn and strong headed and is stuck in his ways. They are convenient narratives but hardly stand up to scrutiny. Unless you want to be completely uncharitable to the man, we have seen him change from a soldier who executed people with backdated laws to someone able to work within the strictures of a democratic system. He also continues to say how he has to work within a democratic constitution to wage an anti-corruption war, a matter close to his heart. What then is it about monetary policy that makes it so hard for him to change? Did monetary policy steal his ice cream as a child? There are many things he clearly wants that he cannot get. So why monetary policy?

In a democratic system, anyone can hold any view they like, including the President. But there are hurdles preventing anyone from imposing their views on the rest of the country. He might think that everyone who stole money should be thrown in jail (or shot) and the key thrown away. But the judiciary acts a hurdle where you must prove your case at a trial, supported by evidence.

It is true that the president holds economic views that went out of fashion before the Berlin Wall came down. But the hurdle to imposing those views on the country has now collapsed. Where Ibe Kachikwu has openly acted as a hurdle against the president’s anti-deregulation instincts, the biddable Godwin Emefiele has collapsed and indulged him.

In November 2014, the Central Bank’s Monetary Policy Committee (MPC) met to discuss the issues Nigeria was facing as they do every month. Note that at the time, oil prices were above $70/barrel. Things were nowhere near as bad as they are now. Here was what they said (PDF, page 20)

In the Committee’s opinion, a more flexible naira in the face of non- existent fiscal buffers was the most viable policy option at a time of heightened demand pressure for foreign exchange and falling oil prices. The Committee was, therefore, of the view that if it failed in taking the right policy actions now, the market would force the Bank to take more drastic actions in the future with far less foreign exchange reserves

They took the view that a flexible exchange rate was the solution to declining reserves and the mess that the government’s finances were in. Based on this, all the members voted to devalue the naira from N155 to N168 per dollar.

Emefiele, in particular, said the following as one of the justifications for devaluing the naira (page 89)

A lower value of the naira would also make Nigerian exports cheaper, which should encourage other countries to buy more Nigerian goods with a potential for increased job creation in the domestic economy.

Also this (page 86)

With the CBN’s ability to defend the naira and sustain the stability of the naira exchange rate being constrained by the depleting reserves, a widening arbitrage premium opened up at the foreign exchange market between the rDAS exchange rate and the rates in the other segments

Again, this was back in November 2014 when reserves were around $40bn. He recognised that people were playing games due to the widening of the gap between official rates and the black market.

Things did not improve and in February 2015, the CBN again devalued the naira to N199 ‘overnight’. This happened outside of the normal MPC (theMPC is rigged in favour of the CBN anyway) meetings so there was no communique to that effect. The following month, March 2015, Emefiele again said this (page 8)

The Committee also took note of the administrative measures implemented by the Bank since the last meeting of the MPC to achieve stability in the foreign exchange market. The Bank had on 18th February 2015 taken the bold supply management measures to close the official window of the foreign exchange market in order to create transparency and minimize arbitrage opportunities in the foreign exchange market

Again, things were nowhere near as bad as they are now. We know what happened next. Buhari took office and brought with him the economic ideas he picked up during the Dark Ages. Anyone knew what to expect from Buhari — he’s no economic genius; his ideas are his ideas. Thus, if you believe in your own ideas, you should be able to defend your position at least to a reasonable extent.

Instead, the moment Buhari took office, Emefiele immediately began to sing a new song. When he was not standing at attention near the president, he was telling blatant lies about how reserves had increased from $29bn to $32bn due to the ‘blocking of leakages’ by the new government (page 5). In reality, the reserves went up because NLNG paid dividends to the government.

Now when you check his comments in the MPC, he simply says that the exchange rate is stable at N199 and no longer makes any mention of the arbitrage opportunities that are dislocating the economy and increasing demand for scarce forex. Yet, we know that the arbitrage opportunities haveincreased from November 2014 when he was concerned about them. The man who once believed in devaluation as a way to boost exports and reduce arbitrage no longer believes in those things. All that has changed is that there is a new president in office.

You can say that this is all down to Buhari and he is the one making Emefiele do this stuff. You are right. But I ask you a simple question — if you were in charge of the CBN, what would you do? Will you do as Emefiele has done? Buhari is economically illiterate and ignorant on such matters — he thinks he is doing the right thing. If he tells you to jump into a river will you do so?

Within a few months of Buhari taking office, he had completely changed his position and surrendered his powers to the President

The President has been very clear on this; the Vice President has been very clear on this and let me further reiterate our position at the CBN, that we are not considering any further depreciation of the currency

I ask again, is this an appropriate way to behave? Will you do the same?

Devaluation or Float?

The fundamental problem facing the Nigerian economy is that it is being starved of foreign currency due to a collapse in the government’s forex earnings from oil. We can all agree that the solution to this is to have more forex available.

One way to make that happen is for the naira to be correctly priced. If you go to the market and things are more expensive than you bargained for, you won’t buy it even if you have the money in your hand. Nigeria’s oil earnings have dropped dramatically. Those oil earnings were the main thing supporting the value of the naira as such, it cannot be possible for the value of the naira to remain the same. But the naira has a value and there are ways to find out what that value is.

You can try devaluing. You test one price, if it sticks, that’s the correct price. If it doesn’t and the currency comes under the pressure again, you devalue again. You keep going till you find the price i.e the price that sticks. The problem with this is that the person doing the devaluing is likely to think that the naira is worth more than the people on the other end of the deal think it is. This is just normal negotiation that happens daily when people want to exchange something. Further, prices are unlikely to stay in one place given that other factors affecting that price are always changing. If militants blow a pipeline, you might need to devalue. If oil prices go up, you might even need to revalue. To effectively do this will probably take up all the capacity at the CBN and they won’t have time to do anything else. But you can do it.

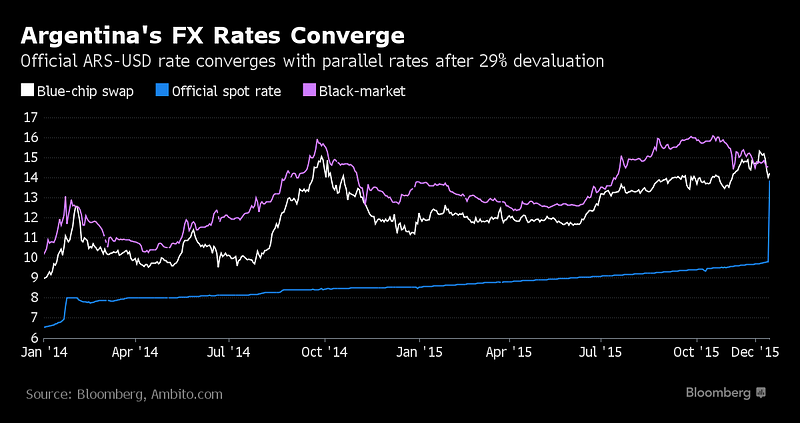

You can also float. In this case, you find out the price once instead of testing multiple times. Also, you leave the price to be determined by those who want to buy naira and sell dollars. Prices are supposed to reflect all the information that is publicly available so if militants blow a pipeline, the market will immediately adjust for that. If a new gusher well is discovered offshore Nigeria, the market will also adjust the naira based on the expectation that Nigeria will earn more money from crude in the future. A practical example of this was when the newly elected Argentine president, Mauricio Macri, floated the peso a few weeks after taking office in December 2015.

The peso immediately dropped by 30% and all the 3 rates converged into one. One strike to find the price. A few months after, Argentina went to the international markets looking for $15bn —instead investors offered it $65bn. You might not like foreign debt and all that, but that is how markets work. When the price is right, people buy. It’s worth noting that Nigeria has been looking for Eurobonds, Panda bonds and Samurai bonds too and has not yet got any luck from the markets.

I know which one I prefer.

The Future

Now that we have seen the results of Buhari’s foolish policies and Emefiele’s kowtowing to him, what to do? Nigeria clearly cannot continue like this waiting for oil prices to go back up. Knowing how things have been going in Nigeria, it is hard for anyone to say Q2 figures will be better than Q1’s. So the possibility of another negative growth quarter is clear and present. The more the economy shrinks, the more jobs are lost.

Consider this scenario. Nigeria floats the currency and it lands at N400 to $1. Since it is floating, no point in keeping any list of who can buy and who cannot. This immediately creates mass unemployment among the black market currency dealers. That is a small price to pay. Nigeria now has one rate so anyone can walk into their bank and buy dollars for any reason they like. If the demand for dollars is too much, the rate goes up to N420. If no one is buying, it can drop to N380.

If you take your naira to buy dollars at N400 to $1, then go and buy champagne from France, put it on a ship to Nigeria, pay custom duties, get it into a shop and then sell it to consumers at a profit, more power to you. We must accept that that is a correct usage of dollars. If it is not possible to do all of that and sell at a price that people will pay, you have to find something else to do and leave champagne business for another time. The economy has to adjust to its new reality and pricing is the only way to do that.

This job would be much easier if we had a Central Bank governor who had the slightest idea what he was doing. Instead he is going along with policies he clearly didn’t believe in very recently. And for what? Buhari will bite his head off if he disagrees with him?

The people who put Emefiele in charge of Nigeria’s monetary policy had their reasons for doing so. Whatever those reasons were, they have now expired. The challenges facing Nigeria today are different and serious. The consequences are that people are losing their jobs and a needless contraction in the economy is now gathering pace.

Ultimately it is President Buhari who will face voters again in 2019 and they will hand him their verdict. In the meantime, there is no reason to cripple the economy as if we are all on a journey to discover the result of an experiment we already know.

Now we have two problems. An economically illiterate president who thinks he’s doing the right thing. In his own case, we can at least assume he doesn’t want to be stoned out of office. But this problem is further compounded by a Central Bank governor who will do and say anything he is told and has not once shown any intellectual capacity that suggests he has any solutions to the immediate crisis facing Nigeria.

One of them is bad enough. Both of them are a disaster. One has to go.

Leave a reply