by Derin Adebayo

Q: What is the addressable market for a technology start-up operating in Nigeria?

A: Nobody knows.

The NCC claims there are 92 million Nigerian internet users, but there are only 16 million Nigerian users on Facebook, the most visited site in Nigeria. There are 20.8 million bank accounts registered for BVNs, but only 2% of bank accounts have more than NGN 500,000 in them.

In probably the biggest disparity of all, 100 million electronic transactions were processed by a single bank in a month, but only 200,000 debit cards are active online in Nigeria. Ironically, both these statistics come from the same source — Interswitch.

Nigerian start ups aren’t the most eager to share their numbers publicly. As privately owned companies they have no reason to share their numbers with anyone except current and potential investors.

This makes it difficult for observers on the outside to judge the actual size of the market for an online service. The fact that we get apparently contrasting figures from different sources doesn’t really help either.

Kinnevik, investors in Nigerian e-commerce site Konga, revealed during its earnings call that Konga has 184,000 active users. Prior to these numbers becoming public, even the most pessimistic observer would have guessed that Konga had significantly more than 1.1% of the Nigerian market as active users. But should we really have been surprised by these numbers in a country where only 3% of adults earn more than N70,000 per month.

This gap in internet users and e-commerce and debit card users shows that while mobile has connected millions of Nigerians to the internet, a significant amount of Nigerians simply can’t afford to shop online and there’s still a long way to go in terms of access to the financial services that will enable many of these new internet users to shop online.

This is why it is really refreshing that Paga puts its most important metrics right on its home page, in real time. As of the time of this post Paga has; 5,003,630 Customers, 10,147+ Agents and 4,907+ Businesses currently on their platform.

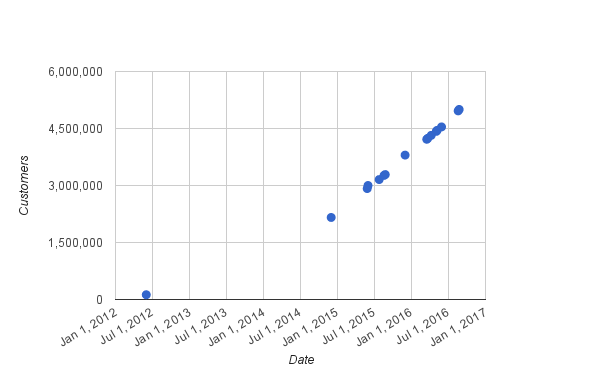

Using my time machine I went back to view cached versions of the home page and I was able to get enough data points to plot a graph of Paga’s growth over the past year.

While both Konga and Jumia are recording slowing growth rates, Paga’s growth is pretty impressive. On a broader level, 5m users — with about 900,000 of them active monthly — shows that the issue is less about how large the market is, but how do you reach the most difficult customers.

E-commerce companies are finding out that although there are 180 million Nigerians, majority of the items sold online may be a luxury to most. But with only about 33% of Nigerian having bank accounts, companies that provide financial services to the unbanked may soon become a necessity.

_________________

Op–ed pieces and contributions are the opinions of the writers only and do not represent the opinions of Y!/YNaija

Derin Adebayo is a financial analyst at Hotels.ng. He can be reached on twitter @DerinAdebayo.

Leave a reply